The SEC vs. Netflix

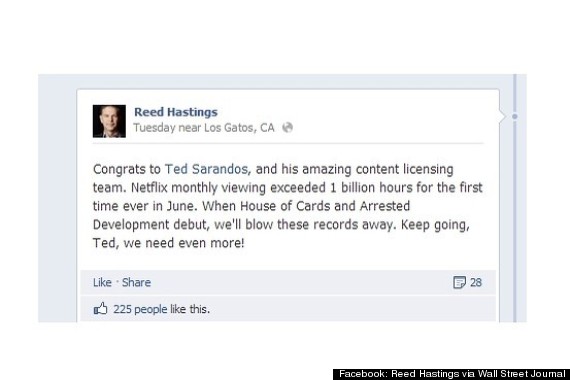

Back in July, Reed Hastings, the CEO of Netflix, posted a message on Facebook, which caused the SEC to warn the company last week of a potential investigation into Netflix’s violation of the Regulation Fair Disclosure. The message itself was short, consisting of only 45 words, and a simple exclamation of his excitement to see that the company has hit the milestone of 1 billion hours viewed in June (see above image).

Netflix disclosed that it received a Wells Notice from the SEC last Thursday, meaning that the SEC staff will recommend the full commission to pursue either a cease-and-desist action and/or a civil injunction. The SEC believes that Hasting’s post has violated Reg FD, the brainchild of Arthur Levitt, former chairman of the commission. The regulation was put in place slightly over a decade ago, originally designed to prevent selective leaks from companies to certain analysts and to promote “full and fair disclosure”. In general, Reg FD states that “when a public company gives material nonpublic information to anyone, the company must also public disclose that information to all investors”.

The SEC claims that by posting the fact that Netflix enjoyed over a billion hours of viewing in a month, Hastings released material information to investors and he did so through an unknown and non-public venue to release important company news. However, Hastings argues that, first of all, the information was non-material, especially since interested parties, viewers of the site, and the general public had known previously that the company was close to this milestone. As to the second part of the SEC’s claim, questioning the public nature of Facebook seems almost comical, especially when Hastings has over 220,000 followers and this post probably reached a lot more people than an SEC filing. However, the SEC might have a point in saying that Netflix did not alert its investors that Facebook was an available channel for information.

Currently, the sentiment both on the Street and online is that the SEC is over-reacting and its silly fetish of trying to control companies and their disclosure methods needs to be adjusted and updated to fit the latest trend in the rise of social media. This case still has a long way to go, and it may lead to an evolution of the SEC into a more modern governing body.

- Jennifer Zhang

Comments

Post a Comment